Accounts

Services

Join Today

Rates

Serving our community since 1936.

Become a Member

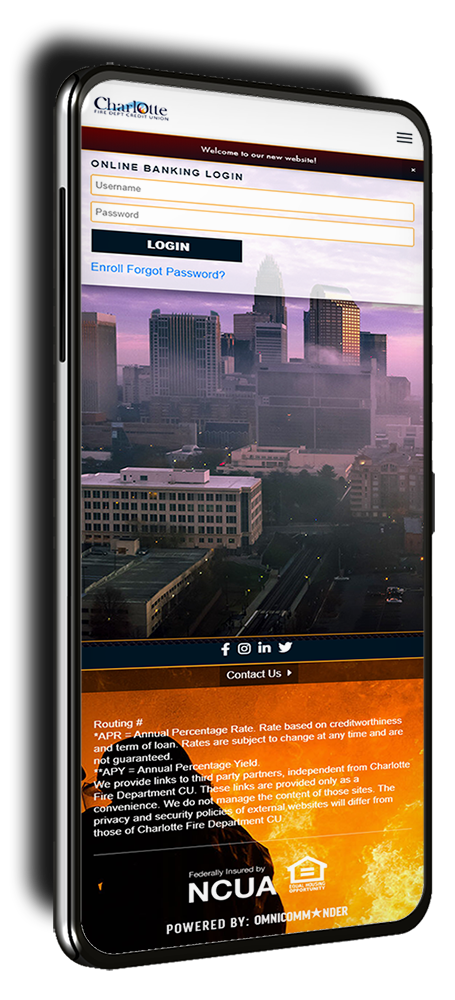

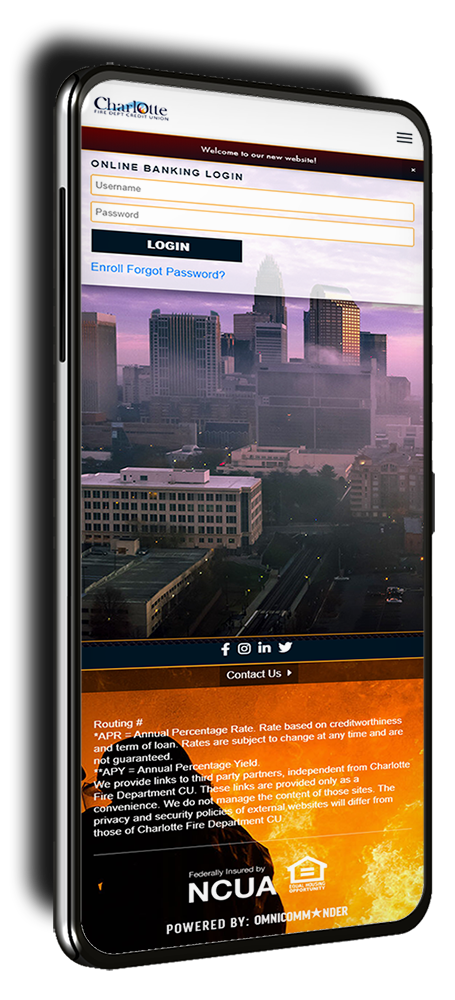

Download Our Mobile App

Download our mobile app and access your account from anywhere!

Download our mobile app and access your account from anywhere!